How Does Estimating Software Help Independent Adjusters?

How Does Estimating Software Help Independent Adjusters?

How Does Estimating Software Help Independent Adjusters?

Discover how the latest contents estimating software is revolutionizing how IA firm's generate estimates.

Discover how the latest contents estimating software is revolutionizing how IA firm's generate estimates.

Nathan Koo

Nathan Koo

Mar 16, 2025

Mar 16, 2025

8 mins

8 mins

Independent Adjusters and Residential Contents Estimation

As an independent adjuster, effectively managing your time is crucial. You are constantly juggling numerous tasks, such as:

Handling multiple claims

Negotiating with insureds

Exploring new opportunities with various firms

However, when dealing with residential property claims, there are certain critical steps that are beyond your control. These include the inventorying of residential contents and estimating their value.

In this blog post, we will focus on contents estimation, which is a significant and time-consuming stage in the claim process that often lacks an effective solution. Your company may choose to conduct these estimations internally or hire an external estimation firm. Regardless, you are left waiting for an estimate that can take days, weeks, or even longer to receive. Taking control of this significant delay in your workflow has the potential to revolutionize the outcomes of your work.

Estimation Challenges Faced by Independent Adjusters

Independent adjusters face a range of challenges when it comes to delivering high-quality results for residential claims:

Delayed estimates can lead to longer claim cycles and result in insureds constantly calling for updates.

Inaccurate estimates can further prolong the cycle times and lead to more complaints.

The cost of estimation tools can eat into the firm's profits.

Estimation tools can be difficult to use and require a steep learning curve.

Insureds may push back on estimates and hire public adjusters.

Additionally, market prices are subject to change, which may require estimates to be re-done over time. This leads us to a commonly asked question:

Is there already a solution that addresses these problems?

Introducing: Estimating Software

Estimating software specifically designed for residential insurance claims allows users to accurately and efficiently determine property values. These software solutions vary among providers, offering different features such as processing speed, accuracy, cost, integration capabilities, and user-friendliness.

Overall, the goal of estimating software is to assist estimators in assessing property values with improved precision and efficiency, with each provider offering their own unique combination of processing speed, accuracy, pricing, integration options, and ease of use.

Estimation Challenges Can Be Addressed With Estimating Software

Delays in Estimates

It is likely that the estimation team at your firm or the third party vendor handling your estimates is currently operating at or beyond full capacity, resulting in delays when providing estimates. This can cause both you and the insured to experience wait times of several days, weeks, or even months for these estimates.

Implementing estimation software can greatly enhance the productivity of your estimation department by automating the process of searching for current product prices, sourcing links, and generating estimation reports. With the ability to provide estimates within the same day, both the carrier and insured will be impressed by the efficiency with which you are resolving their claims.

Estimation Inaccuracies

Inaccurate estimates can have significant consequences, leading to prolonged estimation processes and the need for revisions:

The insured may complain if their belongings are undervalued.

Carriers might be dissatisfied if they believe appraisal prices are too high.

Over time, this can result in increased indemnity for carriers and dissatisfied insureds, which can harm the reputation of your IA firm.

To avoid these issues, it is crucial to invest in highly accurate estimating software that alerts you to review specific items before finalizing your estimate. The reliability and trustworthiness of the software's results are key considerations when making this investment. By reducing the need for estimate revisions, you can focus your attention on items that require human expertise and are more challenging to estimate accurately.

Estimation Solutions are Too Costly

Depending on the size and growth requirements of your firm, you may find it more beneficial to invest in a cost-effective estimation software rather than opting for a pricier solution with additional benefits. For example, third-party estimation services are currently the most expensive option, where you provide an inventory list and receive an estimate in return. While this eliminates the need to handle estimations directly or maintain a dedicated team for estimation, it may not be suitable for:

Individual IA's who work by themselves.

Small IA firms with lower negotiated rates.

IA firms looking to scale up and maximize profit.

Furthermore, many estimation services rely on manual processes or limited technology, which can limit their capacity and ability to provide prompt estimates. This might lead you to think:

Having my own estimation team equipped with the right estimating software is the best solution.

While this might be true, it is important to consider:

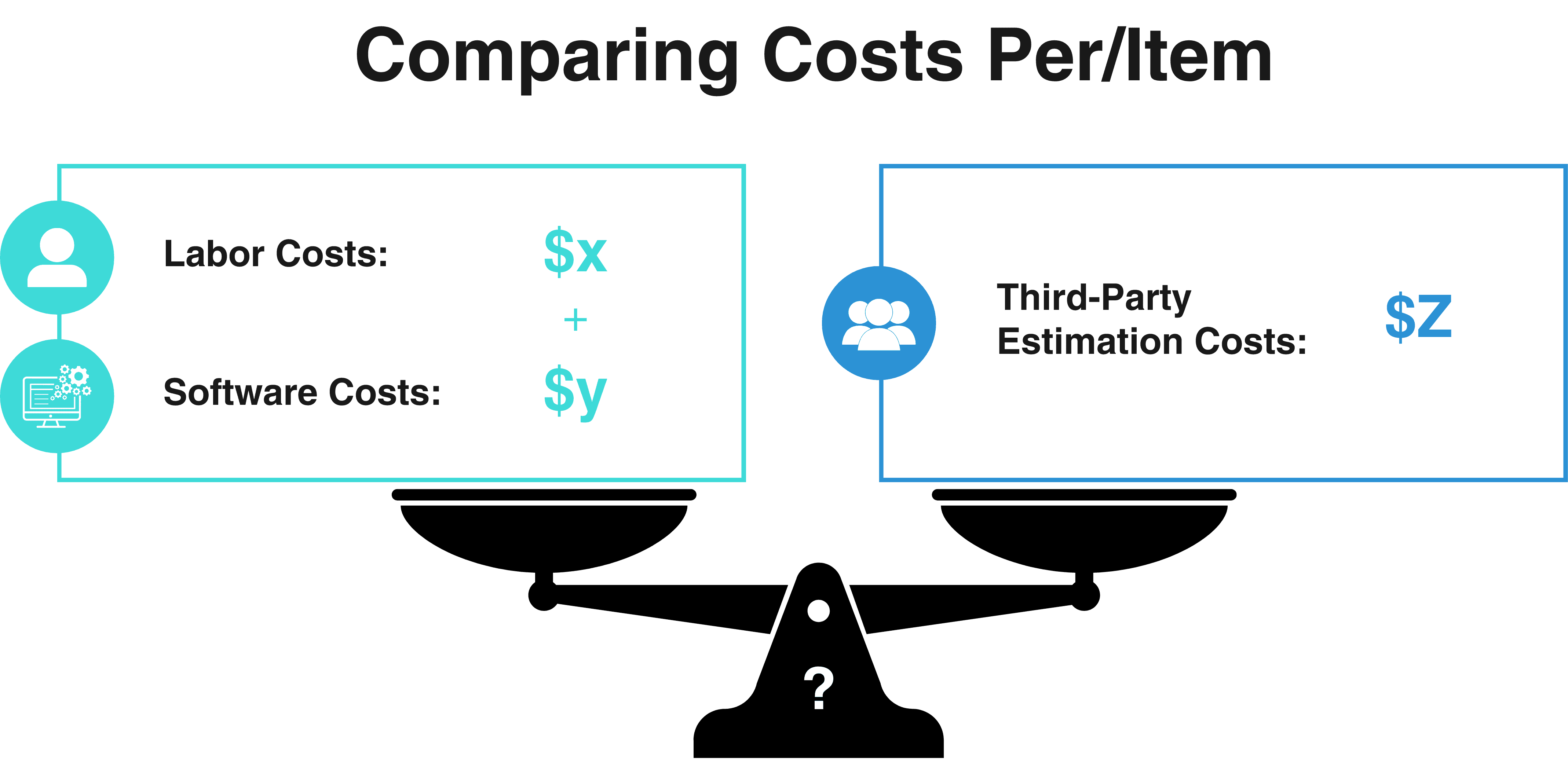

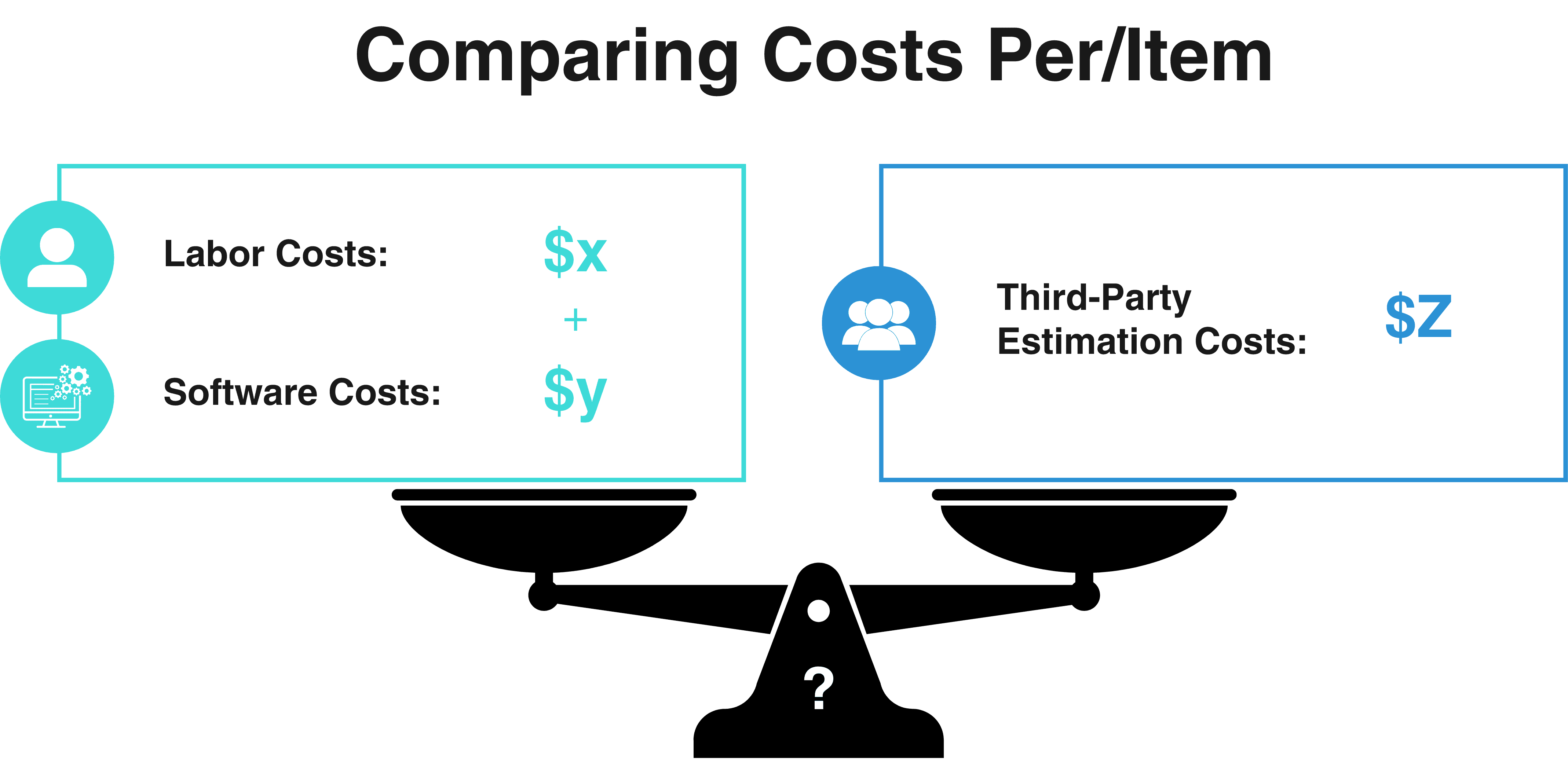

The cost of labor and estimating software vs the expense of hiring a third-party estimator.

The capacity of your estimating team even with estimating software and plan for the scenario when they reach their maximum capacity.

One potential solution could be a combined approach, where your internal estimation team operates at maximum efficiency using the best estimating software available, while also outsourcing remaining estimates to third-party services at a reasonable cost. This way, you can optimize your resources and ensure that all estimates are handled effectively.

Compare the costs of hiring a third-party estimator with maintaining your own in-house estimation team and estimating software before deciding on the best solution.

Unintuitive Estimating Software and Steep Learning Curves

It's also a great idea to consult with colleagues within your industry about the tools they use for contents estimation.

You might discover:

Frustrations regarding the complexity and difficult learning curve of some existing estimating software.

An abundance of extensive, paid online courses for numerous estimating programs, necessitated by their intricate features and learning requirements.

A significant number of estimators still relying on manual methods rather than adopting estimating software (perhaps the adoption curve is too high!).

When evaluating estimation software, it is important to inquire about the onboarding process, access permissions, and training duration during the vendor selection phase. This will enable you to gauge how quickly your team can effectively utilize the software, which in turn affects the cost of implementing new technology and accelerates the application of software benefits to your work.

Insured Pushing Back on Estimates

During the settlement negotiation, it is common for insureds to challenge your prices in an attempt to increase the value of their products. You understand why though:

Your motivations differ slightly and they're trying to maximize their settlement.

However, if you walk into this negotiation with no real basis on your pricing for each item, the insured may begin to question the credibility of your entire estimate. At this point, they may begin to consider hiring a public adjuster because they feel that you are unfairly reducing the value of their property.

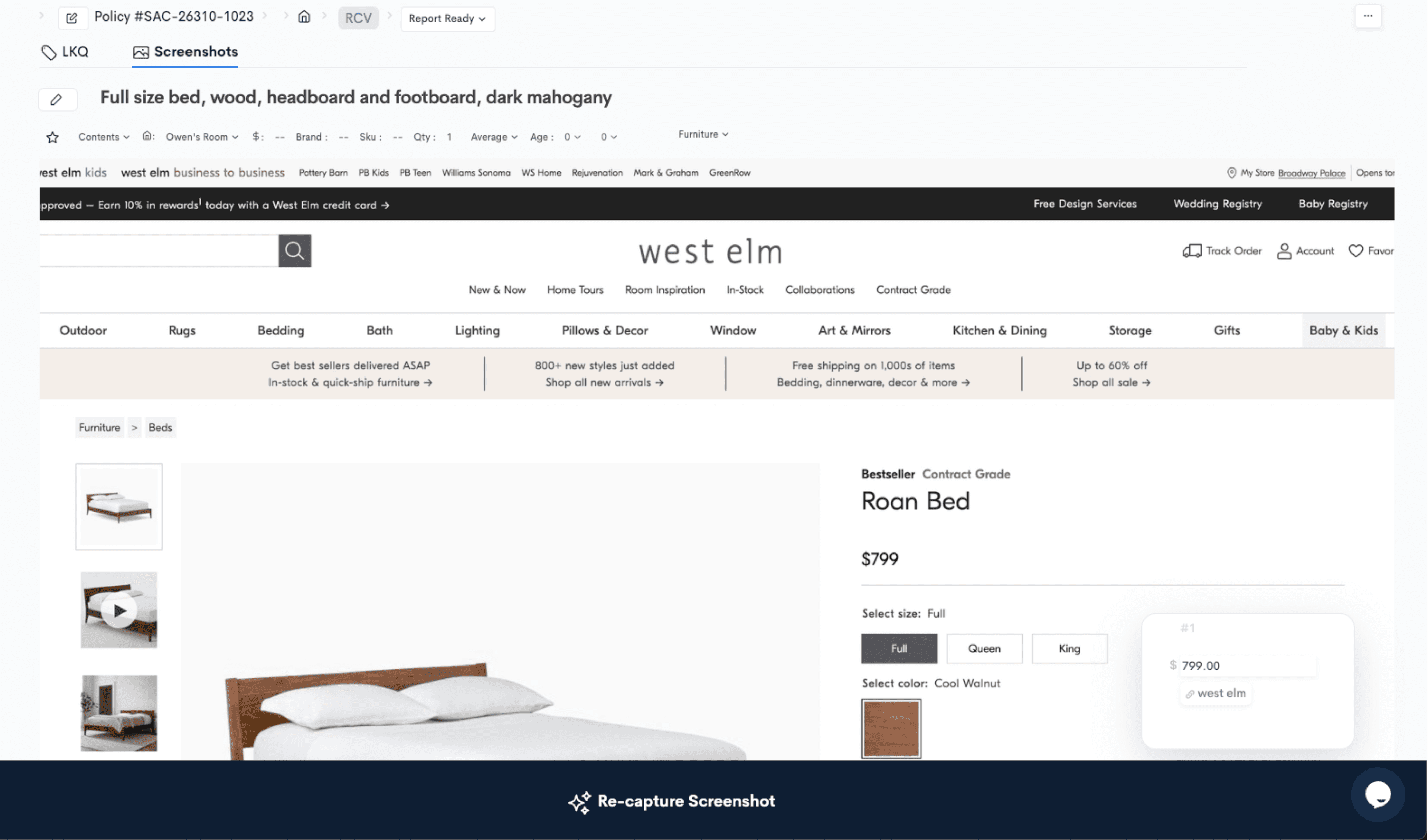

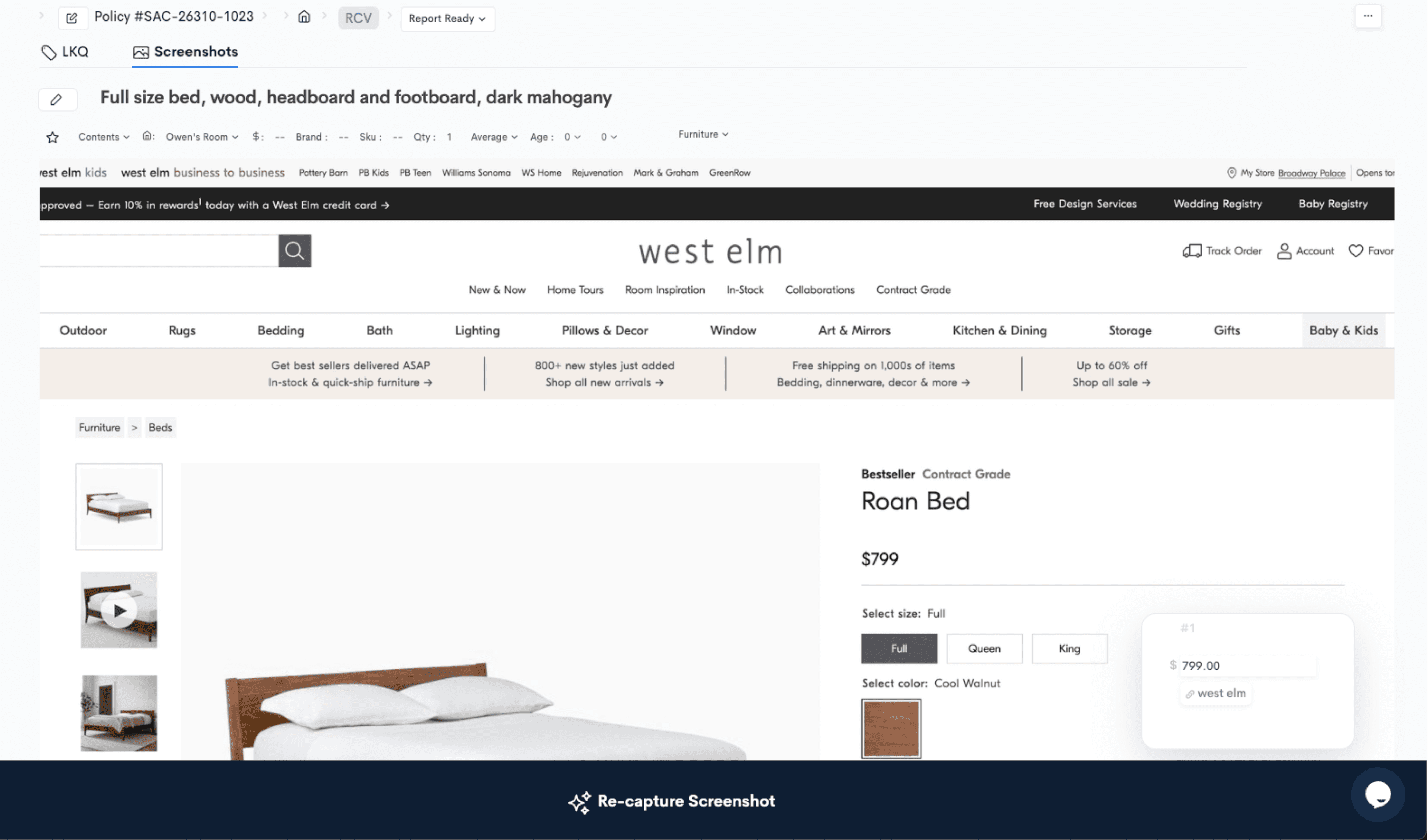

Fortunately, there are several estimating software options available today that can enhance the credibility of your estimates. One such provider, Adjust Square, goes the extra mile by including product screenshots and source links. This feature ensures that there is permanent evidence of the product's online availability on the date the estimate was prepared. As websites can change and links can become outdated, this added feature guarantees transparency and objectivity in your estimates.

Reduced pushback

Increased transparency

Increased objectiveness

Adjust Square's screenshot feature adds transparency and objectivity to your estimate by displaying product details and prices on the estimate date.

A Changing Market's Product Prices

Each day product prices fluctuate on the market. Online retailers control their prices and change them for a variety of reasons:

Discounts and sales

Inflation

Supply & demand

Seasonality

Changing production costs

However, when a settlement is negotiated weeks or even months after the initial estimate is made, the prices may not be suitable for settlement or recoverable depreciation. It may be necessary to reevaluate and estimate some or all of the items.

Fortunately, a few estimation software currently on the market have a feature that refreshes prices:

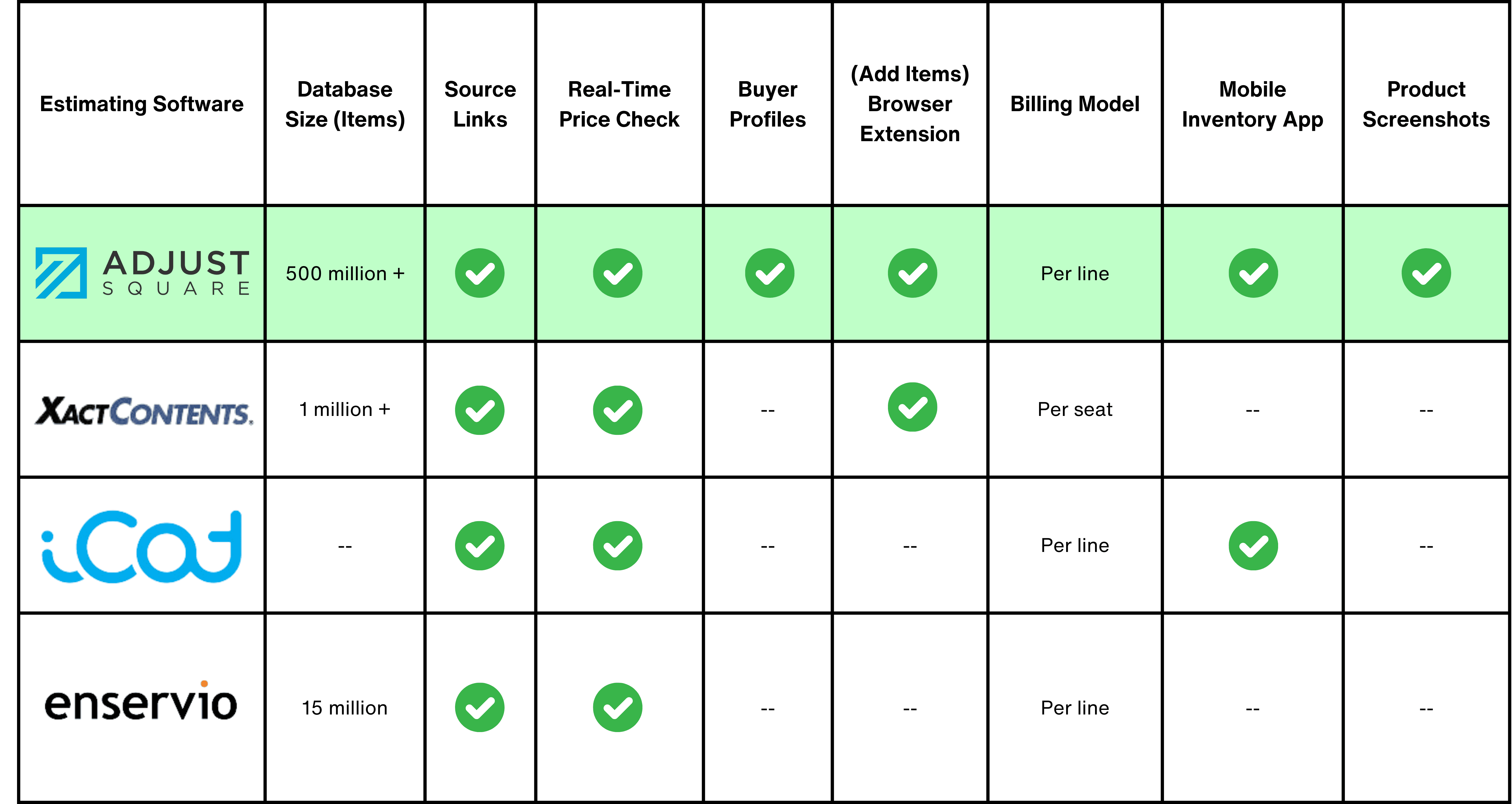

Adjust Square's AI Estimator

Verisk's XactContents

iCat's Fast LKQ

Enservio's Contents Express

A price refresh is great, but the accuracy of the estimating software is still what determines how much work there is to do. Imagine a slow and inaccurate estimating software after a price refresh. The estimate will again require a lot of time and review.

To prevent the hassle of redoing a significant amount of work, it is crucial to select the most accurate estimating software available. This will minimize the need for extensive review after a price refresh.

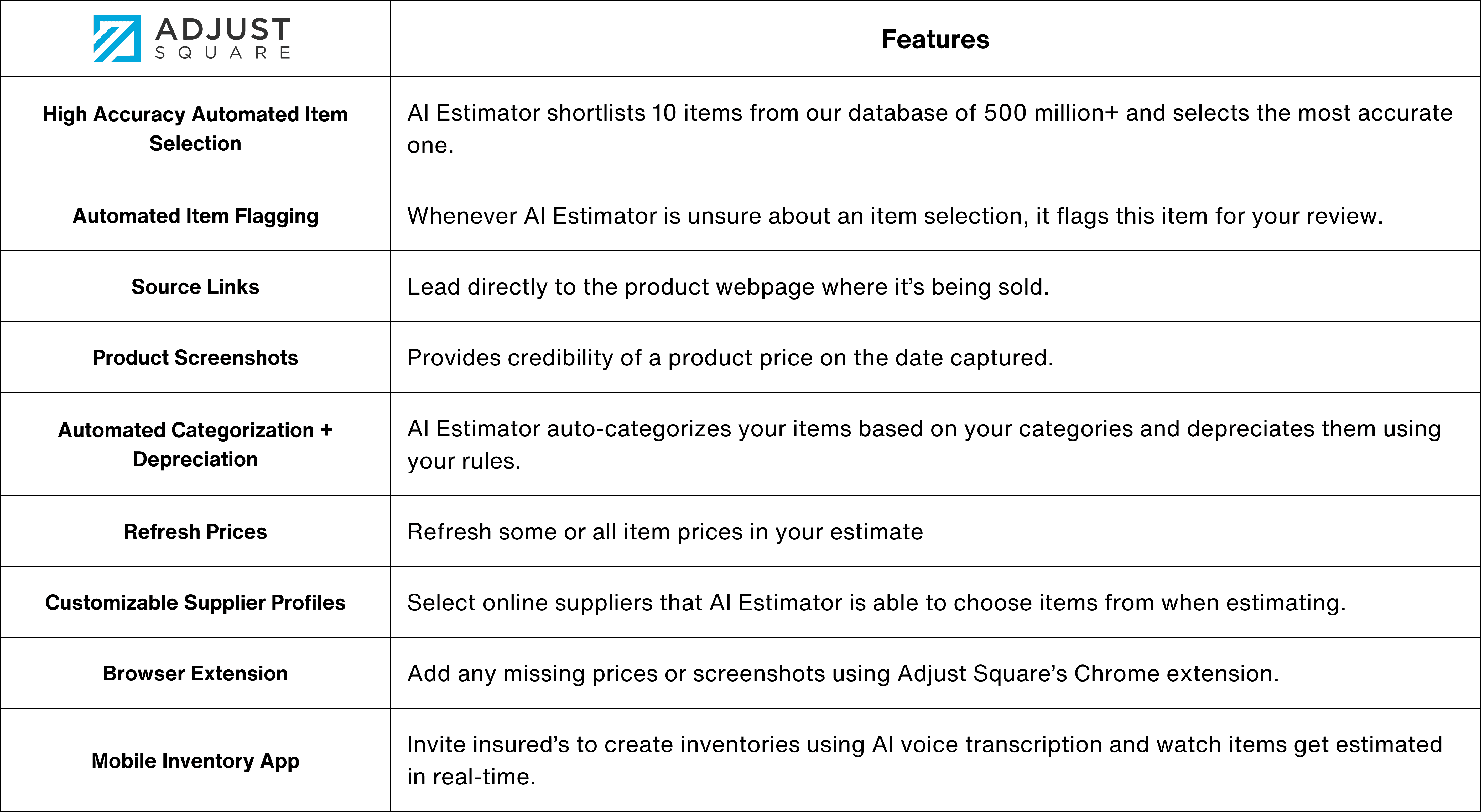

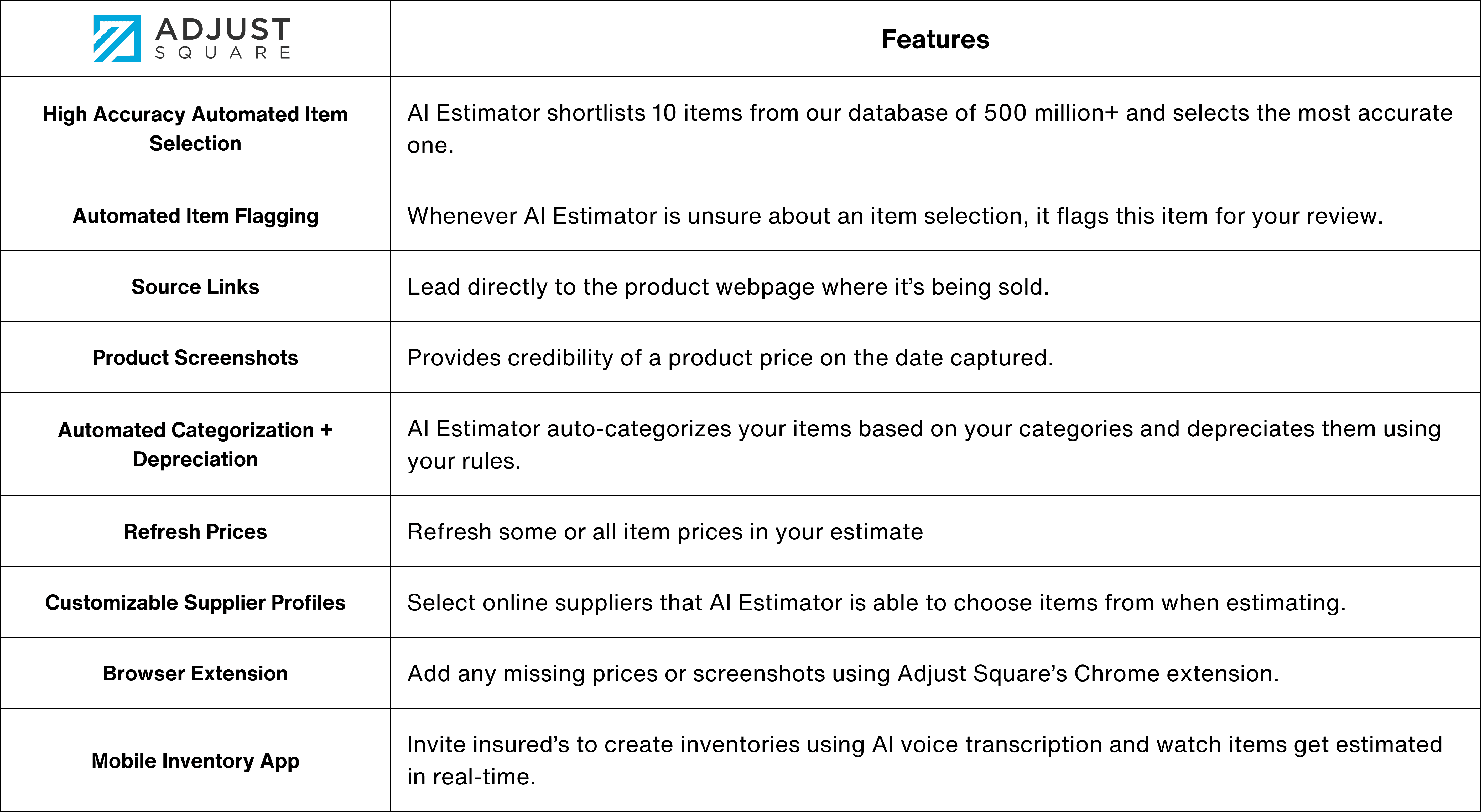

Adjust Square's extensive database and preferred supplier profiles have a significant impact on improving estimation accuracy.

Section Summary

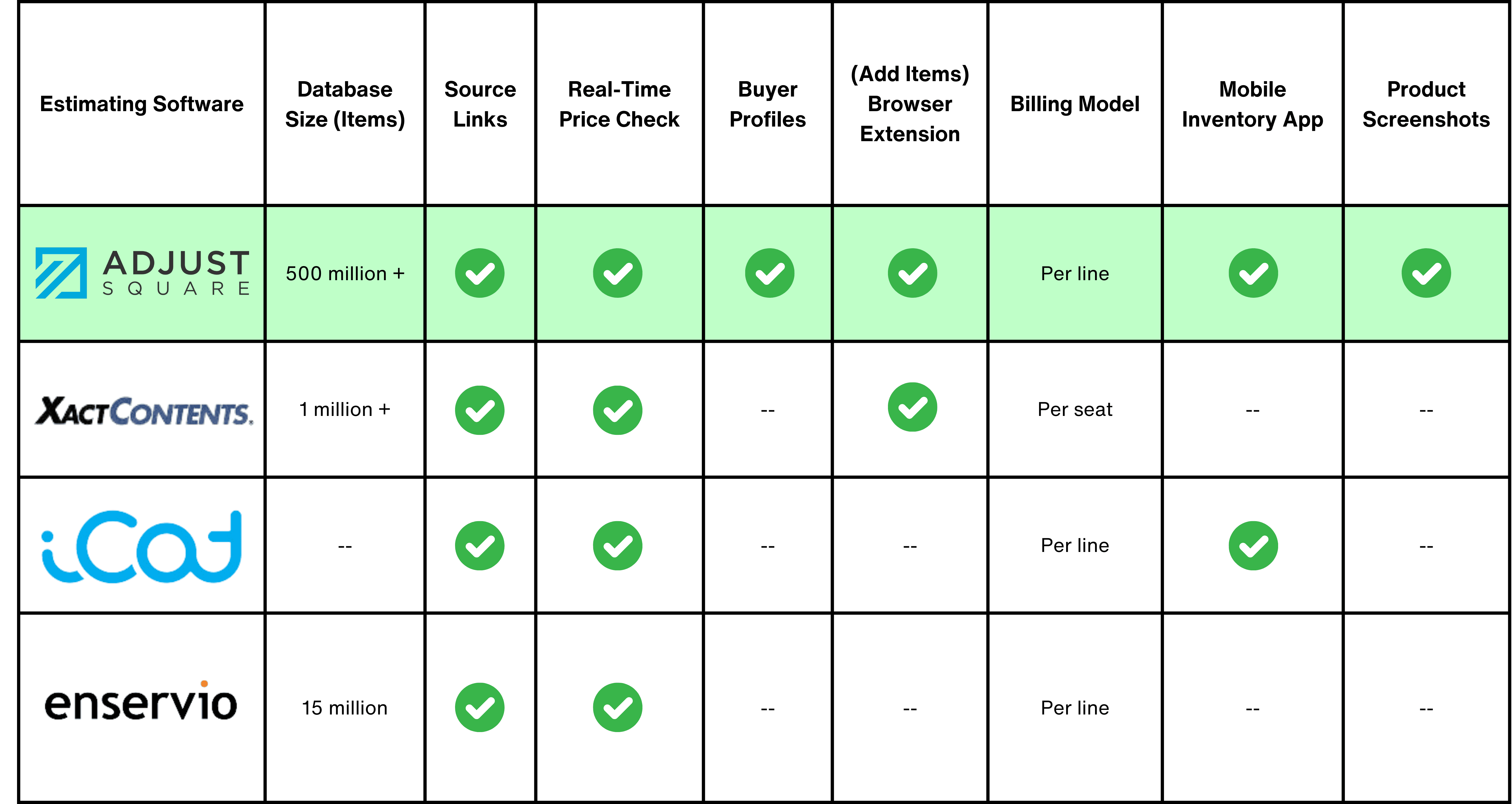

After gaining insight into the solutions provided by estimating software, you may be interested in discovering which estimating software is the most suitable for your firm's needs as an independent adjuster.

For a comprehensive comparison of the Best Insurance Estimating Software in 2024, read our article here. Or you can continue reading below to see our recommendation for the best estimating software for IA firms.

What is the Ultimate Estimating Software for IAs?

This blog post highlights the availability of various estimating software options that can help independent adjusters and their firms overcome the challenges of estimating residential contents. However, it's important to note that relying solely on estimating software may not always be the complete solution for contents estimation. That's why many IA firms adopt a hybrid strategy, combining different tools and approaches. In larger firms, they often start with an internal estimation team, which may or may not utilize estimating software:

They perform various tasks, including:

Creating and utilizing their own customized spreadsheets.

Conducting Google searches for items that are not listed and manually updating their spreadsheets with details such as price, description, and the web link (URL) of the product.

Manually reviewing and correcting any inaccurate estimates from their estimating software.

Organizing products into specific categories for reporting and depreciation calculations.

Occasionally taking screenshots of high-value items manually.

Customizing the estimation report format of the estimating software to align with their preferences.

However, these tasks can be quite time-consuming and labor-intensive for many, placing a significant burden on their estimation team and restricting the number of items they can effectively handle.

Whether you:

Work on large or small claims,

Work for an IA firm or independently,

Specialize in large loss, theft, or minor loss,

you can bypass all these manual tasks and address your entire range of estimation challenges simply by using Adjust Square's AI Estimator.

Conclusion

This article provides a comprehensive discussion on the considerations that IA firms and independent adjusters should keep in mind when searching for a solution to residential estimation challenges.

You now understand:

The various challenges that independent adjusters face when estimating residential contents.

The nature and purpose of estimating software.

How estimating software can effectively tackle the problems encountered by independent adjusters and their firms.

How Adjust Square's AI Estimator specifically addresses these challenges for independent adjusters in residential contents estimation.

In today's technological age, businesses in all industries are constantly seeking ways to enhance value for their clients through new technology solutions. As an IA, the tools you use are heavily influenced by the firm you work for.

If you own an IA firm, competing firms are consistently attracting IA's through better compensation, opportunities, and technology tools. It's important for your firm to have the top technology tools to create a seamless experience for your IA's.

The landscape is changing, and the technology solutions that you and your competitors have been dreaming of are now within reach. Adjust Square is one of these technologies, and we are ready to assist you in tackling your residential contents estimates.

Independent Adjusters and Residential Contents Estimation

As an independent adjuster, effectively managing your time is crucial. You are constantly juggling numerous tasks, such as:

Handling multiple claims

Negotiating with insureds

Exploring new opportunities with various firms

However, when dealing with residential property claims, there are certain critical steps that are beyond your control. These include the inventorying of residential contents and estimating their value.

In this blog post, we will focus on contents estimation, which is a significant and time-consuming stage in the claim process that often lacks an effective solution. Your company may choose to conduct these estimations internally or hire an external estimation firm. Regardless, you are left waiting for an estimate that can take days, weeks, or even longer to receive. Taking control of this significant delay in your workflow has the potential to revolutionize the outcomes of your work.

Estimation Challenges Faced by Independent Adjusters

Independent adjusters face a range of challenges when it comes to delivering high-quality results for residential claims:

Delayed estimates can lead to longer claim cycles and result in insureds constantly calling for updates.

Inaccurate estimates can further prolong the cycle times and lead to more complaints.

The cost of estimation tools can eat into the firm's profits.

Estimation tools can be difficult to use and require a steep learning curve.

Insureds may push back on estimates and hire public adjusters.

Additionally, market prices are subject to change, which may require estimates to be re-done over time. This leads us to a commonly asked question:

Is there already a solution that addresses these problems?

Introducing: Estimating Software

Estimating software specifically designed for residential insurance claims allows users to accurately and efficiently determine property values. These software solutions vary among providers, offering different features such as processing speed, accuracy, cost, integration capabilities, and user-friendliness.

Overall, the goal of estimating software is to assist estimators in assessing property values with improved precision and efficiency, with each provider offering their own unique combination of processing speed, accuracy, pricing, integration options, and ease of use.

Estimation Challenges Can Be Addressed With Estimating Software

Delays in Estimates

It is likely that the estimation team at your firm or the third party vendor handling your estimates is currently operating at or beyond full capacity, resulting in delays when providing estimates. This can cause both you and the insured to experience wait times of several days, weeks, or even months for these estimates.

Implementing estimation software can greatly enhance the productivity of your estimation department by automating the process of searching for current product prices, sourcing links, and generating estimation reports. With the ability to provide estimates within the same day, both the carrier and insured will be impressed by the efficiency with which you are resolving their claims.

Estimation Inaccuracies

Inaccurate estimates can have significant consequences, leading to prolonged estimation processes and the need for revisions:

The insured may complain if their belongings are undervalued.

Carriers might be dissatisfied if they believe appraisal prices are too high.

Over time, this can result in increased indemnity for carriers and dissatisfied insureds, which can harm the reputation of your IA firm.

To avoid these issues, it is crucial to invest in highly accurate estimating software that alerts you to review specific items before finalizing your estimate. The reliability and trustworthiness of the software's results are key considerations when making this investment. By reducing the need for estimate revisions, you can focus your attention on items that require human expertise and are more challenging to estimate accurately.

Estimation Solutions are Too Costly

Depending on the size and growth requirements of your firm, you may find it more beneficial to invest in a cost-effective estimation software rather than opting for a pricier solution with additional benefits. For example, third-party estimation services are currently the most expensive option, where you provide an inventory list and receive an estimate in return. While this eliminates the need to handle estimations directly or maintain a dedicated team for estimation, it may not be suitable for:

Individual IA's who work by themselves.

Small IA firms with lower negotiated rates.

IA firms looking to scale up and maximize profit.

Furthermore, many estimation services rely on manual processes or limited technology, which can limit their capacity and ability to provide prompt estimates. This might lead you to think:

Having my own estimation team equipped with the right estimating software is the best solution.

While this might be true, it is important to consider:

The cost of labor and estimating software vs the expense of hiring a third-party estimator.

The capacity of your estimating team even with estimating software and plan for the scenario when they reach their maximum capacity.

One potential solution could be a combined approach, where your internal estimation team operates at maximum efficiency using the best estimating software available, while also outsourcing remaining estimates to third-party services at a reasonable cost. This way, you can optimize your resources and ensure that all estimates are handled effectively.

Compare the costs of hiring a third-party estimator with maintaining your own in-house estimation team and estimating software before deciding on the best solution.

Unintuitive Estimating Software and Steep Learning Curves

It's also a great idea to consult with colleagues within your industry about the tools they use for contents estimation.

You might discover:

Frustrations regarding the complexity and difficult learning curve of some existing estimating software.

An abundance of extensive, paid online courses for numerous estimating programs, necessitated by their intricate features and learning requirements.

A significant number of estimators still relying on manual methods rather than adopting estimating software (perhaps the adoption curve is too high!).

When evaluating estimation software, it is important to inquire about the onboarding process, access permissions, and training duration during the vendor selection phase. This will enable you to gauge how quickly your team can effectively utilize the software, which in turn affects the cost of implementing new technology and accelerates the application of software benefits to your work.

Insured Pushing Back on Estimates

During the settlement negotiation, it is common for insureds to challenge your prices in an attempt to increase the value of their products. You understand why though:

Your motivations differ slightly and they're trying to maximize their settlement.

However, if you walk into this negotiation with no real basis on your pricing for each item, the insured may begin to question the credibility of your entire estimate. At this point, they may begin to consider hiring a public adjuster because they feel that you are unfairly reducing the value of their property.

Fortunately, there are several estimating software options available today that can enhance the credibility of your estimates. One such provider, Adjust Square, goes the extra mile by including product screenshots and source links. This feature ensures that there is permanent evidence of the product's online availability on the date the estimate was prepared. As websites can change and links can become outdated, this added feature guarantees transparency and objectivity in your estimates.

Reduced pushback

Increased transparency

Increased objectiveness

Adjust Square's screenshot feature adds transparency and objectivity to your estimate by displaying product details and prices on the estimate date.

A Changing Market's Product Prices

Each day product prices fluctuate on the market. Online retailers control their prices and change them for a variety of reasons:

Discounts and sales

Inflation

Supply & demand

Seasonality

Changing production costs

However, when a settlement is negotiated weeks or even months after the initial estimate is made, the prices may not be suitable for settlement or recoverable depreciation. It may be necessary to reevaluate and estimate some or all of the items.

Fortunately, a few estimation software currently on the market have a feature that refreshes prices:

Adjust Square's AI Estimator

Verisk's XactContents

iCat's Fast LKQ

Enservio's Contents Express

A price refresh is great, but the accuracy of the estimating software is still what determines how much work there is to do. Imagine a slow and inaccurate estimating software after a price refresh. The estimate will again require a lot of time and review.

To prevent the hassle of redoing a significant amount of work, it is crucial to select the most accurate estimating software available. This will minimize the need for extensive review after a price refresh.

Adjust Square's extensive database and preferred supplier profiles have a significant impact on improving estimation accuracy.

Section Summary

After gaining insight into the solutions provided by estimating software, you may be interested in discovering which estimating software is the most suitable for your firm's needs as an independent adjuster.

For a comprehensive comparison of the Best Insurance Estimating Software in 2024, read our article here. Or you can continue reading below to see our recommendation for the best estimating software for IA firms.

What is the Ultimate Estimating Software for IAs?

This blog post highlights the availability of various estimating software options that can help independent adjusters and their firms overcome the challenges of estimating residential contents. However, it's important to note that relying solely on estimating software may not always be the complete solution for contents estimation. That's why many IA firms adopt a hybrid strategy, combining different tools and approaches. In larger firms, they often start with an internal estimation team, which may or may not utilize estimating software:

They perform various tasks, including:

Creating and utilizing their own customized spreadsheets.

Conducting Google searches for items that are not listed and manually updating their spreadsheets with details such as price, description, and the web link (URL) of the product.

Manually reviewing and correcting any inaccurate estimates from their estimating software.

Organizing products into specific categories for reporting and depreciation calculations.

Occasionally taking screenshots of high-value items manually.

Customizing the estimation report format of the estimating software to align with their preferences.

However, these tasks can be quite time-consuming and labor-intensive for many, placing a significant burden on their estimation team and restricting the number of items they can effectively handle.

Whether you:

Work on large or small claims,

Work for an IA firm or independently,

Specialize in large loss, theft, or minor loss,

you can bypass all these manual tasks and address your entire range of estimation challenges simply by using Adjust Square's AI Estimator.

Conclusion

This article provides a comprehensive discussion on the considerations that IA firms and independent adjusters should keep in mind when searching for a solution to residential estimation challenges.

You now understand:

The various challenges that independent adjusters face when estimating residential contents.

The nature and purpose of estimating software.

How estimating software can effectively tackle the problems encountered by independent adjusters and their firms.

How Adjust Square's AI Estimator specifically addresses these challenges for independent adjusters in residential contents estimation.

In today's technological age, businesses in all industries are constantly seeking ways to enhance value for their clients through new technology solutions. As an IA, the tools you use are heavily influenced by the firm you work for.

If you own an IA firm, competing firms are consistently attracting IA's through better compensation, opportunities, and technology tools. It's important for your firm to have the top technology tools to create a seamless experience for your IA's.

The landscape is changing, and the technology solutions that you and your competitors have been dreaming of are now within reach. Adjust Square is one of these technologies, and we are ready to assist you in tackling your residential contents estimates.

Share article

Nathan Koo

Nathan Koo is co-founder of Adjust Square – a provider of insurance estimating software focused on automating contents estimates with AI. He recognizes the impressive capabilities of AI but also sees the irreplaceable value of human interaction. He supports combining high-tech solutions with the essential human element for optimal balance. In his spare time, he enjoys cooking, making new friends, and staying active with sports.

Nathan Koo

Nathan Koo is co-founder of Adjust Square – a provider of insurance estimating software focused on automating contents estimates with AI. He recognizes the impressive capabilities of AI but also sees the irreplaceable value of human interaction. He supports combining high-tech solutions with the essential human element for optimal balance. In his spare time, he enjoys cooking, making new friends, and staying active with sports.

Nathan Koo

Nathan Koo is co-founder of Adjust Square – a provider of insurance estimating software focused on automating contents estimates with AI. He recognizes the impressive capabilities of AI but also sees the irreplaceable value of human interaction. He supports combining high-tech solutions with the essential human element for optimal balance. In his spare time, he enjoys cooking, making new friends, and staying active with sports.

Other Related Blogs

Other Related Blogs

Aug 5, 2025

Aug 5, 2025

Aug 5, 2025

AI Contents Claims: How Estimators Are Automating Replacement Matching and Pricing

AI Contents Claims: How Estimators Are Automating Replacement Matching and Pricing

AI Contents Claims: How Estimators Are Automating Replacement Matching and Pricing

Nathan Koo

Nathan Koo

Nathan Koo

Jul 13, 2025

Jul 13, 2025

Jul 13, 2025

Create a Home Inventory: Key Considerations

Create a Home Inventory: Key Considerations

Create a Home Inventory: Key Considerations

Nathan Koo

Nathan Koo

Nathan Koo

Jul 12, 2024

Jul 12, 2024

Jul 12, 2024

Comparing The Best Insurance Estimating Software in 2024

Comparing The Best Insurance Estimating Software in 2024

Comparing The Best Insurance Estimating Software in 2024

Nathan Koo

Nathan Koo

Nathan Koo

Jan 30, 2024

Jan 30, 2024

Jan 30, 2024

Unlocking the Secrets of AI Contents Estimation: A Results-driven Case Study

Unlocking the Secrets of AI Contents Estimation: A Results-driven Case Study

Unlocking the Secrets of AI Contents Estimation: A Results-driven Case Study

Nathan Koo

Nathan Koo

Nathan Koo

Industry leading insights delivered weekly.

Industry leading insights delivered weekly.

Industry leading insights delivered weekly.

Industry leading insights delivered weekly.

Our latest case studies, product reviews, & industry best practices for free.

Our latest case studies, product reviews, & industry best practices for free.