Unlocking the Secrets of AI Contents Estimation: A Results-driven Case Study

Unlocking the Secrets of AI Contents Estimation: A Results-driven Case Study

Unlocking the Secrets of AI Contents Estimation: A Results-driven Case Study

Discover how AI Estimator increased a firm's estimation output by 3x within the first few months of adopting their first estimation software.

Discover how AI Estimator increased a firm's estimation output by 3x within the first few months of adopting their first estimation software.

Nathan Koo

Nathan Koo

Jan 30, 2024

Jan 30, 2024

6 mins

6 mins

In the changing insurance world, efficiency and accuracy in claims processing are important. Our client, an Independent Adjustment (IA) firm, faced challenges in handling personal property claims. They used a mix of in-house and third-party adjusters, but this approach was not efficient or cost-effective. The firm experienced issues with third-party vendor quality and costs, leading them to seek a solution.

Identifying the Problem: Inefficiency and High Costs

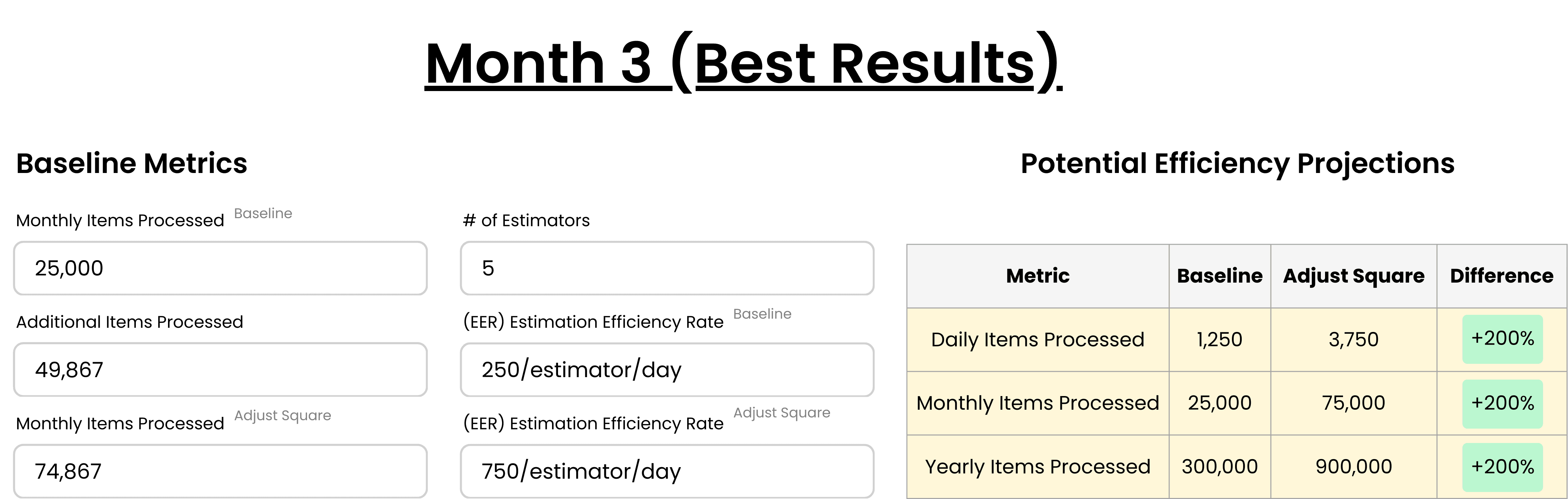

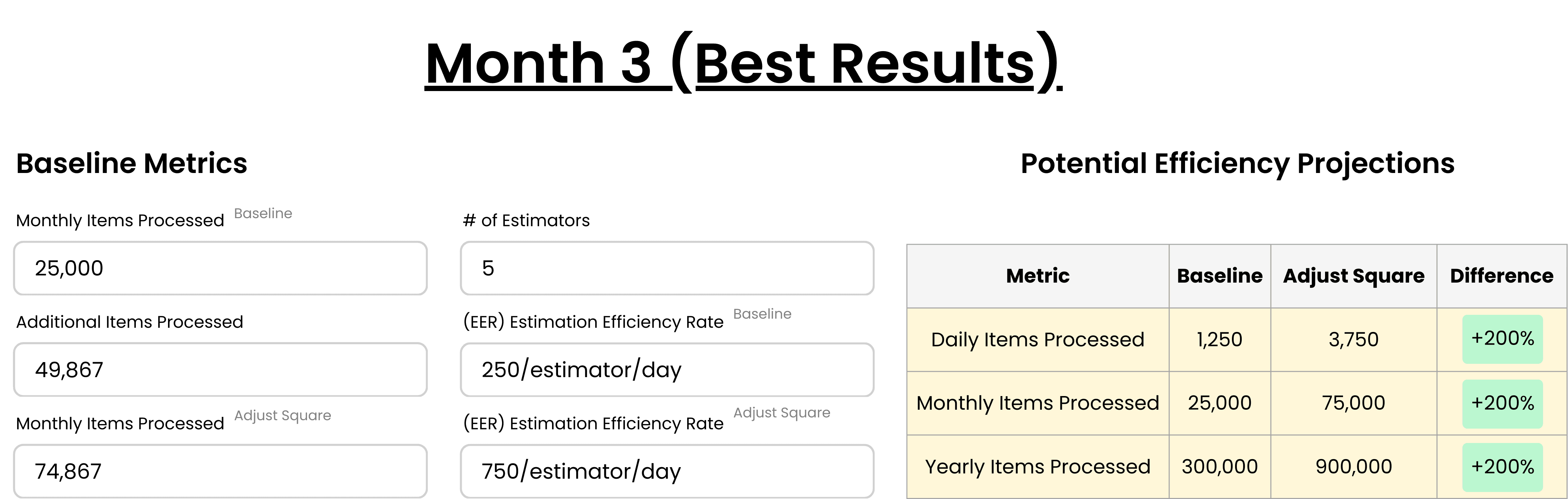

The firm's process was unsustainable due to reliance on third-party vendors, resulting in variable quality and financial strain. The in-house team was limited to processing 1,250 items per day. The firm had a backlog of about 100,000 items and to eliminate third-party vendors, they needed to double their processing capacity to 2,500 items per day, which meant hiring five more estimators and increasing overhead costs.

Implementing a Solution: Customized AI Estimating Software

The challenge was to use technology to manage all contents estimates in-house, without adding staff or expenses. The firm needed a solution to improve productivity and maintain quality in a cost-effective way.

Achieving Results: Enhanced Efficiency and Consistency

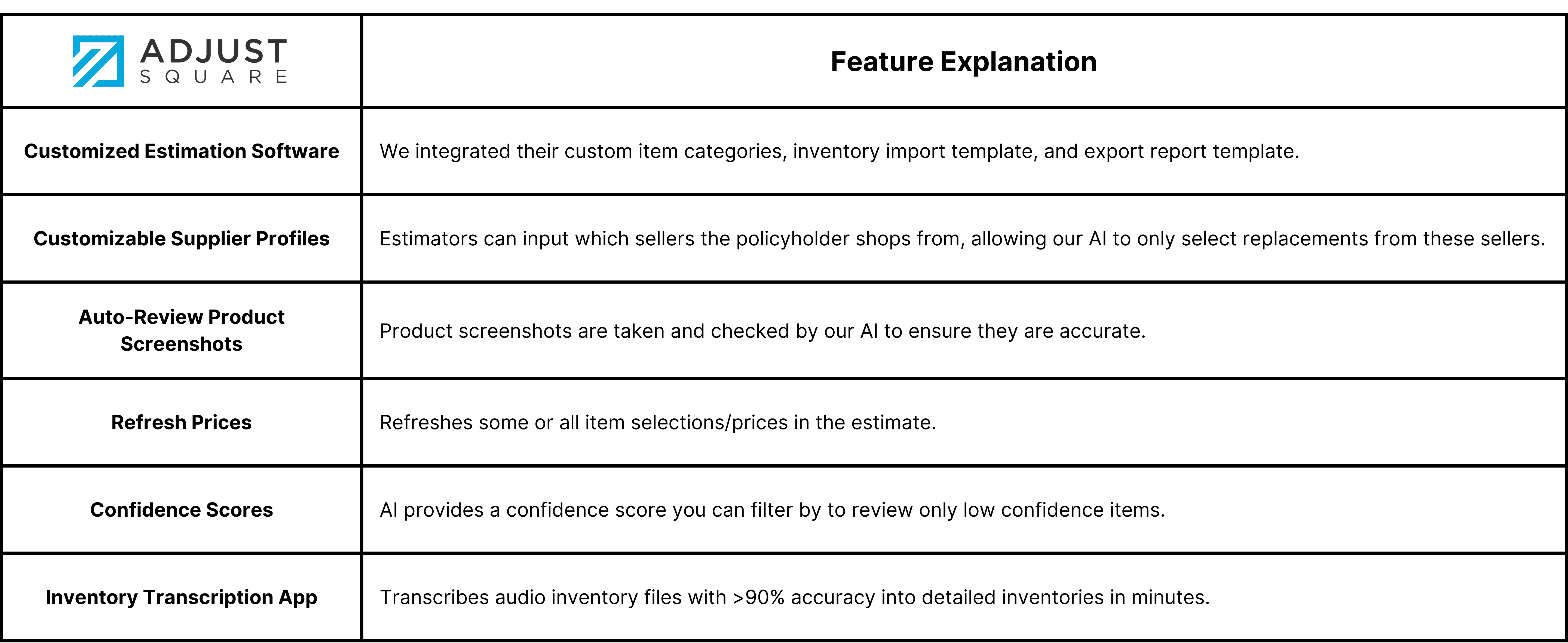

We customized our AI-powered contents estimating software for the firm's needs. Over three months, we worked closely with the firm to tailor the software, train the team, and gather feedback. This ensured a smooth integration with minimal disruption. The firm successfully brought all contents estimation in-house, eliminating the need for third-party vendors. They tripled their process efficiency and are now able to handle 2,500 items per day without increasing staff. This resulted in cost savings and consistent quality across all claims. The software's scalability allows for handling more volume without losing efficiency or accuracy.

By month 3, the client had tripled their item output and began digging into their backlog of 100,000 items.

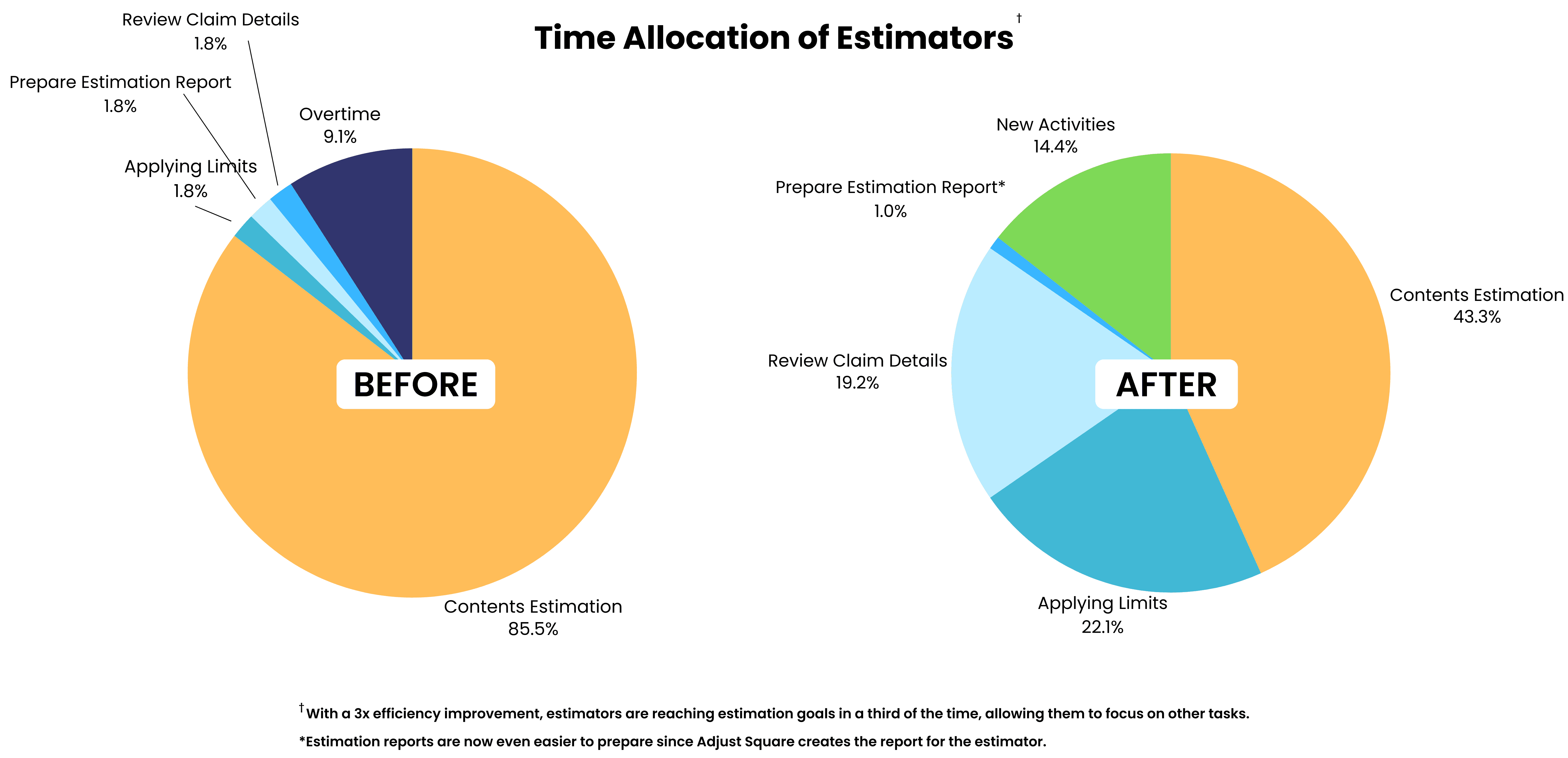

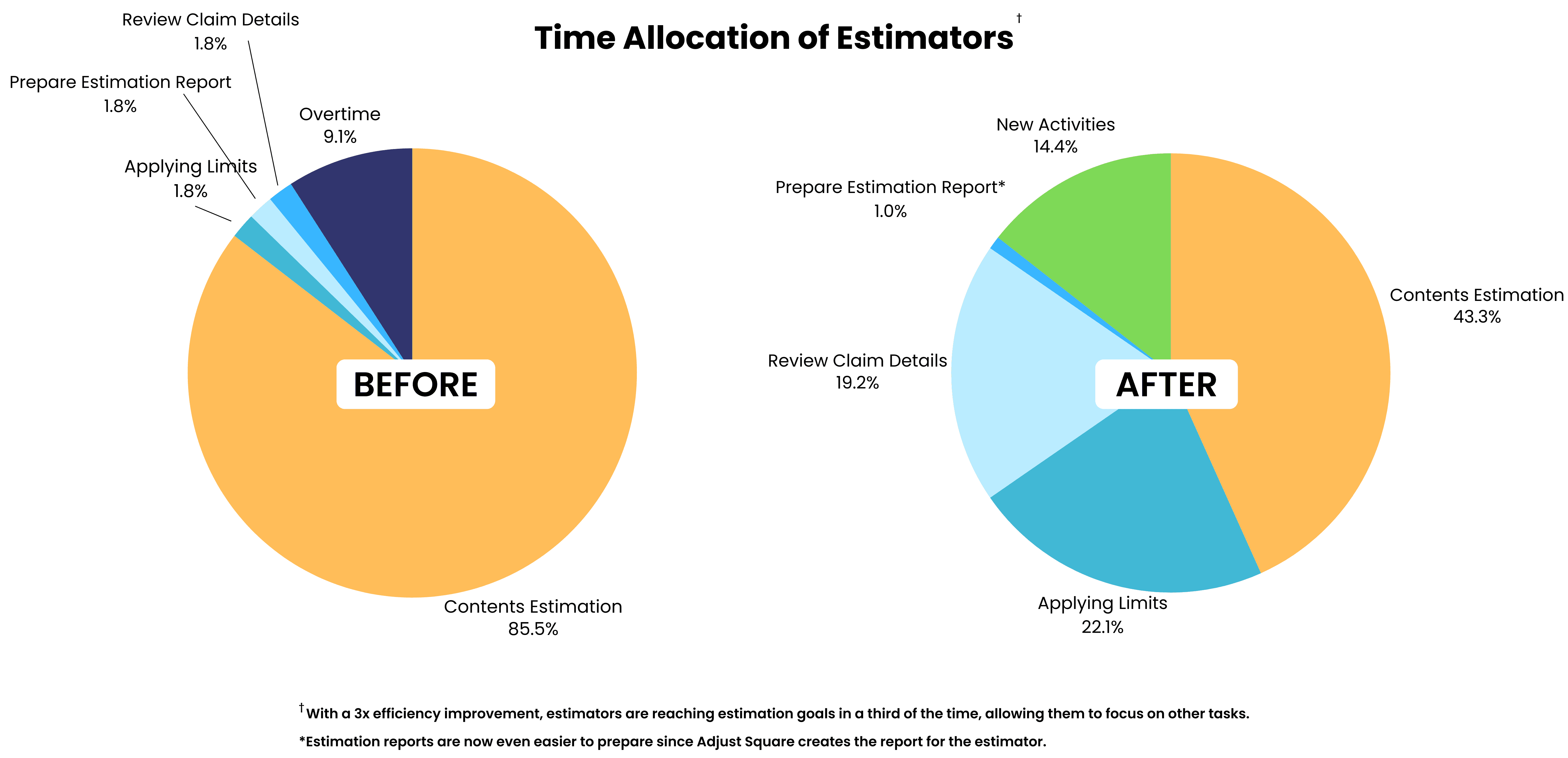

Our client was able to reallocate their estimator's time towards more important tasks, such as applying limits and coverages.

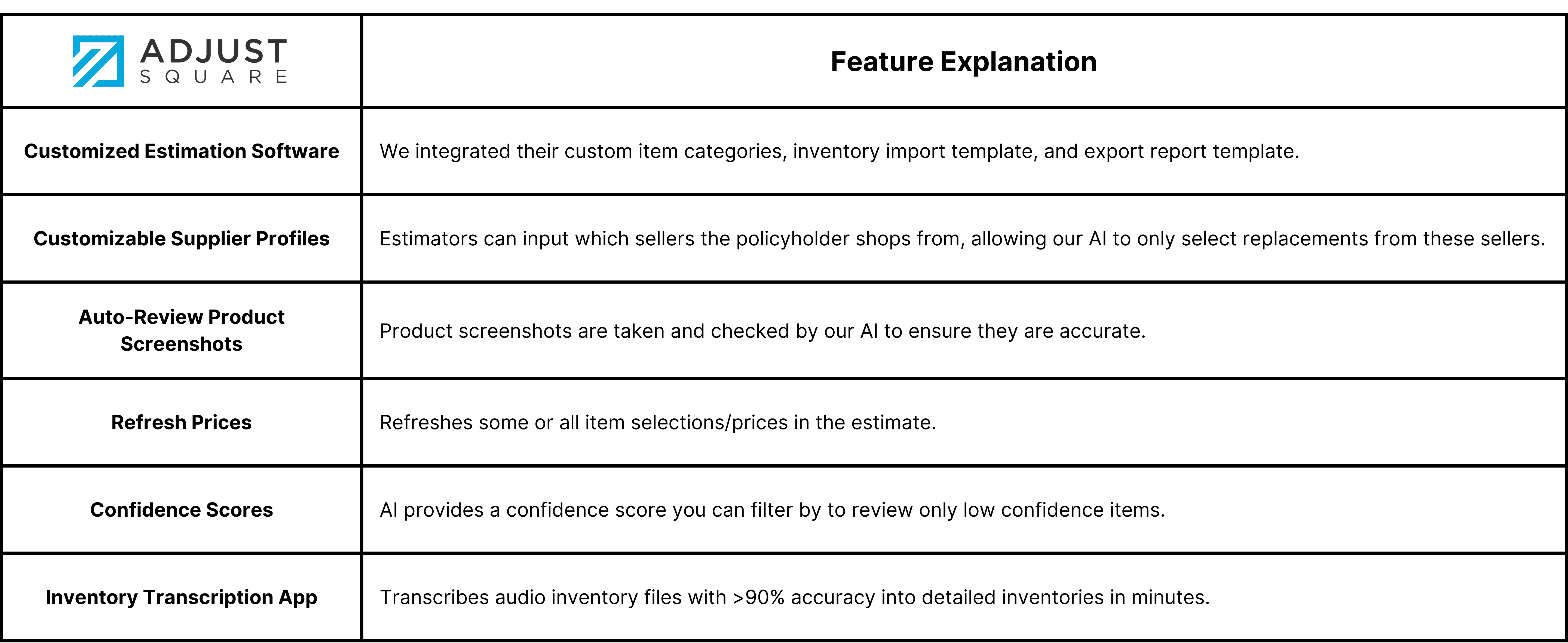

Lastly, it's important to note that achieving a 3x increase in efficiency is just the beginning with Adjust Square. Our dedicated team is constantly working on developing new features to eliminate mundane tasks, allowing them to prioritize important tasks and scale their business.

For example, our team successfully fulfilled 6 new feature requests and customizations during the client's Proof-of-Concept (POC) period, based on theirs and other client's needs.

Conclusion: Impactful Technology in Insurance

Using contents estimating software in personal property insurance is impactful, as shown by our client's experience. By using our AI software, the firm:

Increased operational efficiency by 3x,

Achieved consistent quality across all of their estimates,

Addressed their backlog, leading to faster turnaround times and client service.

Our partnership with the client IA firm demonstrates how technology can set new industry standards and the importance of choosing the right partners for digital transformation.

In the changing insurance world, efficiency and accuracy in claims processing are important. Our client, an Independent Adjustment (IA) firm, faced challenges in handling personal property claims. They used a mix of in-house and third-party adjusters, but this approach was not efficient or cost-effective. The firm experienced issues with third-party vendor quality and costs, leading them to seek a solution.

Identifying the Problem: Inefficiency and High Costs

The firm's process was unsustainable due to reliance on third-party vendors, resulting in variable quality and financial strain. The in-house team was limited to processing 1,250 items per day. The firm had a backlog of about 100,000 items and to eliminate third-party vendors, they needed to double their processing capacity to 2,500 items per day, which meant hiring five more estimators and increasing overhead costs.

Implementing a Solution: Customized AI Estimating Software

The challenge was to use technology to manage all contents estimates in-house, without adding staff or expenses. The firm needed a solution to improve productivity and maintain quality in a cost-effective way.

Achieving Results: Enhanced Efficiency and Consistency

We customized our AI-powered contents estimating software for the firm's needs. Over three months, we worked closely with the firm to tailor the software, train the team, and gather feedback. This ensured a smooth integration with minimal disruption. The firm successfully brought all contents estimation in-house, eliminating the need for third-party vendors. They tripled their process efficiency and are now able to handle 2,500 items per day without increasing staff. This resulted in cost savings and consistent quality across all claims. The software's scalability allows for handling more volume without losing efficiency or accuracy.

By month 3, the client had tripled their item output and began digging into their backlog of 100,000 items.

Our client was able to reallocate their estimator's time towards more important tasks, such as applying limits and coverages.

Lastly, it's important to note that achieving a 3x increase in efficiency is just the beginning with Adjust Square. Our dedicated team is constantly working on developing new features to eliminate mundane tasks, allowing them to prioritize important tasks and scale their business.

For example, our team successfully fulfilled 6 new feature requests and customizations during the client's Proof-of-Concept (POC) period, based on theirs and other client's needs.

Conclusion: Impactful Technology in Insurance

Using contents estimating software in personal property insurance is impactful, as shown by our client's experience. By using our AI software, the firm:

Increased operational efficiency by 3x,

Achieved consistent quality across all of their estimates,

Addressed their backlog, leading to faster turnaround times and client service.

Our partnership with the client IA firm demonstrates how technology can set new industry standards and the importance of choosing the right partners for digital transformation.

Share article

Nathan Koo

Nathan Koo is co-founder of Adjust Square – a provider of insurance estimating software focused on automating contents estimates with AI. He recognizes the impressive capabilities of AI but also sees the irreplaceable value of human interaction. He supports combining high-tech solutions with the essential human element for optimal balance. In his spare time, he enjoys cooking, making new friends, and staying active with sports.

Nathan Koo

Nathan Koo is co-founder of Adjust Square – a provider of insurance estimating software focused on automating contents estimates with AI. He recognizes the impressive capabilities of AI but also sees the irreplaceable value of human interaction. He supports combining high-tech solutions with the essential human element for optimal balance. In his spare time, he enjoys cooking, making new friends, and staying active with sports.

Nathan Koo

Nathan Koo is co-founder of Adjust Square – a provider of insurance estimating software focused on automating contents estimates with AI. He recognizes the impressive capabilities of AI but also sees the irreplaceable value of human interaction. He supports combining high-tech solutions with the essential human element for optimal balance. In his spare time, he enjoys cooking, making new friends, and staying active with sports.

Other Related Blogs

Other Related Blogs

Aug 5, 2025

Aug 5, 2025

Aug 5, 2025

AI Contents Claims: How Estimators Are Automating Replacement Matching and Pricing

AI Contents Claims: How Estimators Are Automating Replacement Matching and Pricing

AI Contents Claims: How Estimators Are Automating Replacement Matching and Pricing

Nathan Koo

Nathan Koo

Nathan Koo

Jul 13, 2025

Jul 13, 2025

Jul 13, 2025

Create a Home Inventory: Key Considerations

Create a Home Inventory: Key Considerations

Create a Home Inventory: Key Considerations

Nathan Koo

Nathan Koo

Nathan Koo

Jul 12, 2024

Jul 12, 2024

Jul 12, 2024

Comparing The Best Insurance Estimating Software in 2024

Comparing The Best Insurance Estimating Software in 2024

Comparing The Best Insurance Estimating Software in 2024

Nathan Koo

Nathan Koo

Nathan Koo

Industry leading insights delivered weekly.

Industry leading insights delivered weekly.

Industry leading insights delivered weekly.

Industry leading insights delivered weekly.

Our latest case studies, product reviews, & industry best practices for free.

Our latest case studies, product reviews, & industry best practices for free.